#missed emi payment

Explore tagged Tumblr posts

Text

Why Paying EMIs on Time Matters: A Path to Financial Stability

In the complex landscape of personal finance, one simple yet vital practice stands out – paying Equated Monthly Installments (EMIs) on time. Whether you're dealing with a housing loan, a car loan, a personal loan, or credit card debt, adhering to timely EMI payments is a cornerstone of financial success. This article explores the reasons behind the significance of paying EMIs punctually and highlights the benefits it bestows on individuals striving to achieve their financial goals.

1. Boost Your Credit Score:

The foremost reason to prioritize on-time EMI payments is the substantial impact they have on your credit score. Your credit score acts as a numerical reflection of your creditworthiness, influencing your eligibility for favorable loan terms and interest rates. By consistently paying your EMIs on schedule, you establish a robust payment history – a fundamental factor in calculating your credit score. Conversely, delayed or missed EMI payments can lower your credit score, making it challenging to access credit and loans in the future.

2. Evade Late Payment Charges:

Late payments often come with unwanted consequences, including penalties and fees imposed by lenders. Failing to meet an EMI deadline can lead to additional financial strain in the form of late payment charges. These charges can accumulate over time and disrupt your financial planning. Adhering to timely EMI payments helps you sidestep these extra costs, allowing you to manage your financial commitments more effectively.

3. Uphold Your Financial Reputation:

Your financial reputation is built upon your ability to fulfill your financial obligations. Timely EMI payments showcase your reliability and responsibility as a borrower. This reputation extends beyond loans, influencing various financial aspects such as job applications, rental agreements, and insurance premiums. By consistently meeting your EMI commitments, you safeguard your financial reputation and open doors to numerous opportunities.

4. Mitigate Stress and Anxiety:

Financial stress is a common concern that can take a toll on your overall well-being. Late or missed EMI payments can exacerbate this stress, affecting your mental and emotional health. Paying EMIs on time helps alleviate the stress linked with financial uncertainty, empowering you to manage your financial responsibilities with confidence.

5. Realize Financial Aspirations:

Most loans are taken out with specific objectives in mind – buying a home, funding education, owning a vehicle, and more. Timely EMI payments propel you closer to achieving these aspirations within your stipulated timelines. Consistency in repayment ensures you stay on course to realize your long-term financial goals.

6. Cultivate Favorable Lender Relationships:

Punctual EMI payments cultivate positive relationships with lenders. Lenders value borrowers who exhibit reliability and consistency, which could translate into better terms and conditions on future loans. Moreover, maintaining a strong track record of on-time payments might provide you with more flexible repayment options or potential loan modifications during times of financial adversity.

Conclusion:

The significance of paying EMIs on time cannot be emphasized enough. Timely EMI payments wield far-reaching effects on your credit score, financial reputation, and overall financial well-being. By prioritizing these payments, you not only circumvent late payment fees and penalties but also establish a sturdy groundwork for attaining your financial objectives. An organized approach to managing your finances and honoring your commitments showcases your financial prudence and dedication to a prosperous financial future.

#emi payment#credit score#missed emi payment#Paying EMIs on Time#Financial Stability#personal finance

0 notes

Text

Consequences of Credit Card Default: Navigating the Pitfalls of Missed Payments

Introduction In the fast-paced world of evolving payment gateways in India, the credit card has maintained its popularity despite the emergence of various alternatives. This article explores the repercussions of frequently missing credit card payments, shedding light on the nuances of credit card default. Understanding Credit Card Default What constitutes a credit card default? When delving into…

View On WordPress

#asset acquisition#avoid defaulting#blocked credit card account#consequences#credit card default#credit card EMIs#credit score impact#financial credibility#financial health#financial turmoil#high-interest rates#legal action#missed payments#proactive measures#responsible credit usage#timely payments

0 notes

Text

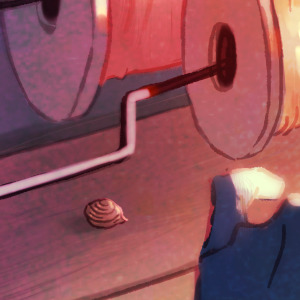

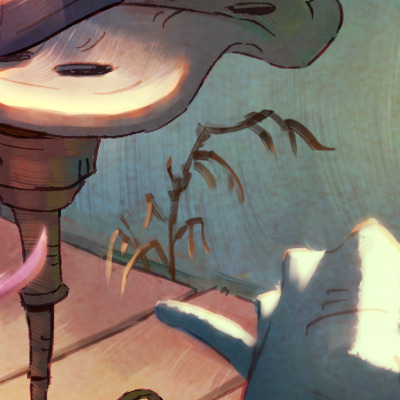

The whole Once-ler family is working full tilt!

Here's my full piece for the VK Onceler Zine! I was very lucky to get to be a part of it...🥹 I used concept art as my inspiration this time: [link] Keep reading below for my process vid and all my director's commentary!

Thank you for being curious! Here's a video of my WIPs:

Deadlines were TIGHT for this zine! We were given only 2 months (compared to the 6 months I had on the previous onceler zine), so to make sure I could finish on time, I decided to do only base colours and lighting, with almost no shading anywhere. Still, trying to balance all the colours took the longest for me, as you can see in the vid. xP

Also idk if anyone noticed, but for the face I chose to use an already existing onceler doodle: [link] Why? Well, why not! I really liked that doodle and I didn't want it to go to waste. 😆

Things that I enjoyed sneaking in:

-the golden spiral! Vaguely, at least! At the very least I hope your eyes can follow the order of thneed production, from the fallen tree at the window to the tuft harvesting to the thread spinning, to knitting the thneed and then drawing up plans for bigger and better things, and then ending with him pulling on his iconic glove to show he's going to take control now

-15 cents, a nail, and a great great great grandfather snail, as well as a tin pail since that's where you're supposed to deposit your payment

-combining things from the 2012 movie and concept art, the 1972 movie, and the 1971 book (e.g. that funny wrench he uses to fix pipes)

-Miss O'Schmunce-ler! You can see from the vid that I added the bracelet pretty late, because it was a late decision to have a Miss O'Schumunce-ler somewhere. I chose her to be the one picking up the pencil in the end, since she's pretty good with a pencil in the movie hehe. You guys can pretend the arms holding the phone is Miss Funce-ler.

-a thneed, a seed, and a (grickle grass) weed on the floor. The thneed is just the first of many that will soon create a giant pile. The seed lies forgotten in the corner. The weed is foreshadowing the future.

-hinting that Lorax and Once-ler were actually good friends, like they were in the Lorax musical stageplay. 🥺 I kept this part of the script in my mind for this piece:

This was aftermath Once-ler talking to the Lorax, reminiscing on their good times...and also being stupid and inconsiderate because the Lorax was in fact there all along as his friend, trying to warn him of what was going to happen. 😔

So in my zine piece we're witnessing a peaceful time before all the real biggering really starts. I like to think that in this scene, the Lorax had been sitting on the Once-ler's lap, holding his gloves for him and having a nice chat together with maybe some harmless bickering, but then the Once-ler gets a phone call so he cuts their convo short and rolls his chair over to the window to answer it. Putting business over friendship as usual, of course. Inspo for the lap sitting comes from this fanart by Emi that I love: [link]

What else...the parts that I'm proud of the most are the stool (I spent 2 days just drawing this stool), the curtains, the fact that I was able to include every truffula colour, and the Once-ler's pose. I was close to giving up on that pose because I had no idea how to draw it but I'm glad that I tried again. I wanted to show him at ease during a stage in his life that we never got to see much: the happier and more innocent days of his biggering when he only had a small shop. 😊

That's all, I think! Thanks for reading if you did! Once again it was an honour to be part of this zine!!

#onceler zine#miru art#onceler#the lorax#lorax#thneed#artists on tumblr#truffula#truffula tree#truffula trees

664 notes

·

View notes

Text

If you think nobody cares if you're alive, try missing a couple of EMI payments

visit https://services.hirerer.com/ to know more

#WeirdAndWonderful #LaughOutLoud #QuirkyQuotes #WackyWorld #CrazyCreativity #UnleashTheWeird #rentahr #OutOfJob #Hirerer #iHRAssist #smartlyhr #smartlyhiring

#poster#startup#founder#entrepreneur#hiring#recruiters#recruitment#human resources#digital illustration

3 notes

·

View notes

Text

The Complete Guide to Dental Implant Cost in Hyderabad

Dental implants have become a go-to solution for people seeking a permanent fix for missing teeth. In Hyderabad, known for its advanced healthcare facilities, dental implants are increasingly popular due to their effectiveness and durability. However, understanding the dental implant cost in Hyderabad can be complex, given the varying factors involved. This guide breaks down the costs, influencing factors, and other crucial details to help you make an informed decision.

What Are Dental Implants?

Dental implants are artificial tooth roots made from biocompatible materials, usually titanium. They are surgically placed into the jawbone to support prosthetic teeth like crowns, bridges, or dentures. Dental implants are preferred for their natural appearance, functionality, and durability, often lasting a lifetime with proper care.

How Much Do Dental Implants Cost in Hyderabad?

The dental implant cost in Hyderabad ranges between ₹20,000 and ₹60,000 per implant, depending on several factors. For full-mouth dental implants, the costs can rise significantly, often ranging between ₹3,00,000 and ₹8,00,000. Below is a breakdown of potential expenses:

Basic Components of Dental Implant Costs

Consultation Fees: ₹500–₹2,000

Diagnostics (X-rays, CT Scans): ₹1,000–₹5,000

Implant Material: ₹20,000–₹45,000 per implant

Crown Cost: ₹5,000–₹20,000 per tooth

Surgical Procedure Costs: ₹15,000–₹30,000

Additional Procedures (Bone Grafting, Sinus Lift): ₹10,000–₹40,000

Factors Influencing Dental Implant Cost in Hyderabad

1. Implant Material and Brand

Premium Implants: Brands like Nobel Biocare or Straumann are more expensive but offer superior quality and long-term success rates.

Affordable Implants: Indian-manufactured implants like Equinox or Dentium are cost-effective alternatives.

2. Type of Procedure

Single-Tooth Implant: Costs ₹20,000–₹60,000.

Multiple Implants: Reduced costs per implant due to economies of scale.

All-on-4 or All-on-6 Implants: Advanced procedures for full-mouth rehabilitation, ranging between ₹2,50,000 and ₹8,00,000.

3. Dentist's Expertise and Clinic Location

Experienced implantologists with international certifications may charge a premium. Clinics in upscale areas like Jubilee Hills or Banjara Hills often have higher pricing compared to clinics in other parts of the city.

4. Additional Treatments

Procedures like bone grafting (₹10,000–₹40,000) or sinus lifts (₹20,000–₹50,000) may be required for patients with insufficient bone density.

5. Type of Crown

Porcelain Fused to Metal (PFM): ₹5,000–₹15,000 per crown.

Zirconia Crowns: ₹12,000–₹25,000, known for superior aesthetics and durability.

Are Dental Implants in Hyderabad Affordable?

Compared to international markets, the dental implant cost in Hyderabad is affordable due to lower overhead costs and competitive pricing among dental clinics. For instance, a single implant in the United States can cost anywhere from $3,000 to $5,000, whereas the same procedure in Hyderabad costs significantly less while maintaining high standards of care.

Ways to Reduce Dental Implant Cost in Hyderabad

Opt for Dental Tourism: Hyderabad is a dental tourism hub, offering high-quality implants at competitive rates for international patients.

Government or University Clinics: Some institutions like NIMS Dental Wing offer affordable dental implant services.

Payment Plans: Many clinics provide EMI options or payment plans to make the treatment more accessible.

Choosing the Right Dental Clinic in Hyderabad

When selecting a clinic for dental implants, consider the following:

Accreditation and Certifications: Look for NABH-accredited clinics.

Experience: Choose a clinic with certified implantologists and a proven track record.

Facilities: Ensure they use advanced technology like CBCT scans and CAD/CAM for precision.

Patient Reviews: Check online reviews or get referrals from trusted sources.

Case Study: A Patient’s Experience with Dental Implants in Hyderabad

Patient Name: Ramesh Kumar Procedure: Single-tooth implant with bone grafting. Cost Breakdown:

Consultation and Diagnostics: ₹3,000

Implant Surgery: ₹25,000

Bone Grafting: ₹15,000

Crown Placement: ₹12,000

Total Cost: ₹55,000 Outcome: Ramesh reports a 95% improvement in chewing efficiency and aesthetic confidence.

Advantages of Dental Implants

Durability: Lasts a lifetime with proper care.

Natural Appearance: Matches natural teeth perfectly.

Enhanced Functionality: Restores chewing and speaking capabilities.

Bone Preservation: Prevents jawbone deterioration caused by missing teeth.

FAQs About Dental Implant Cost in Hyderabad

1. Are dental implants covered by insurance?

Most dental insurance plans in India do not cover implants, but some comprehensive health policies may include them. Consult your insurance provider for details.

2. How long does the implant process take?

The entire process, including healing time, may take 3–6 months, depending on the patient’s bone health and procedure type.

3. What are the risks associated with dental implants?

While implants are generally safe, risks include infection, nerve damage, or implant failure in rare cases. Selecting a skilled dentist minimizes these risks.

Conclusion

The dental implant cost in Hyderabad is significantly more affordable than in other global destinations while maintaining high standards of care. By understanding the factors influencing costs, selecting the right clinic, and exploring financing options, you can make a well-informed decision. Whether you're looking for a single implant or a full-mouth restoration, Hyderabad offers a range of options to meet diverse needs and budgets.

0 notes

Text

Whyte Dental: Your Trusted Dentist in Mysore – Schedule Your Appointment Today

Visit Whyte Dental Clinic Today!!!

Contact Us Today!!!

Introduction

Oral health is a cornerstone of overall well-being. A healthy smile not only boosts confidence but also impacts your physical and emotional health. At Whyte Dental, Mysore’s trusted dental clinic, patients receive top-notch care tailored to their unique needs. With a commitment to excellence and the latest in dental technology, Whyte Dental ensures your journey to a healthier, brighter smile is smooth and stress-free.

Why Choose Whyte Dental for Your Dental Care?

Renowned Dental Professionals

At Whyte Dental, your oral health is in expert hands. The clinic boasts a team of skilled dentists specializing in everything from routine check-ups to complex cosmetic and restorative procedures. Their collective experience ensures patients receive the best possible care.

Comprehensive Dental Services

Whyte Dental is your one-stop destination for all dental needs. Whether you’re looking for preventive care, a smile makeover, or emergency dental services, the clinic provides tailored solutions for every stage of life.

Cutting-Edge Technology

Whyte Dental stays at the forefront of innovation. With advanced diagnostic tools and minimally invasive techniques, patients benefit from precise treatments with quicker recovery times and less discomfort.

Services Offered at Whyte Dental

Preventive Dentistry

Prevention is better than cure, and Whyte Dental focuses on maintaining oral health with regular cleanings, fluoride treatments, and protective sealants to guard against cavities.

Restorative Dentistry

From fillings to dental implants, Whyte Dental offers restorative treatments that repair and replace damaged or missing teeth. These solutions ensure function and aesthetics are restored.

Cosmetic Dentistry

Transform your smile with cosmetic treatments like teeth whitening and veneers. Whyte Dental’s smile makeover services are tailored to enhance your confidence and appearance.

Orthodontics

Achieve perfectly aligned teeth with options like invisible aligners and traditional braces. Whyte Dental offers orthodontic solutions for children, teens, and adults alike.

Emergency Dental Services

Dental emergencies can strike anytime, and Whyte Dental is prepared to handle urgent cases like toothaches, injuries, or infections with prompt care and expertise.

The Patient Journey at Whyte Dental

Easy Appointment Scheduling

Booking an appointment is a breeze with Whyte Dental’s online and phone-based options. Flexible timings ensure that even busy schedules can accommodate a visit.

Comprehensive Initial Consultation

Visit Whyte Dental Today!!!

Get in Touch with Us!!!.

Book an appointment Now!!!

Focus on Patient Comfort

Whyte Dental prioritizes patient comfort with its relaxing environment and attentive staff. Sedation options are available for those who experience anxiety during dental visits.

Patient-Centric Care at Whyte Dental

Transparent Communication

Understanding your treatment is key. Whyte Dental ensures patients receive clear explanations of procedures, timelines, and costs, fostering trust and confidence.

Affordable Pricing and Payment Plans

High-quality dental care doesn’t have to break the bank. Whyte Dental offers competitive rates and flexible EMI options, making advanced treatments accessible to all.

Post-Treatment Support

The care doesn’t end after a procedure. Whyte Dental provides detailed guidance on maintaining oral health and schedules follow-up appointments to monitor progress.

Conclusion

Your smile deserves the best care, and Whyte Dental is here to deliver it. With skilled professionals, advanced technology, and a commitment to excellence, Whyte Dental is Mysore’s trusted destination for all dental needs. Don’t wait—schedule your appointment today and take the first step toward a healthier, brighter smile.

#dental care in mysore#dental in mysore#emergency dental clinic in mysore#dentist in mysore#emergency dentist#dental clinic in mysore#dental clinic near me#dental care#dentist near me#dental implants

0 notes

Text

How Much Does A Full Mouth Dental Implant Cost In Delhi

Full mouth dental implants (with immediate-loading functionality) are a transformative solution for individuals seeking a permanent and natural-looking replacement for their missing teeth. If you need a life-changing procedure in Delhi, it is important to understand the cost and associated components. Let us have a look at the Full Mouth Dental Implant Cost and various aspects that will help you make an informed decision.

Breaking Down the Cost of Full-Mouth Dental Implants

The cost of full-mouth dental implants in Delhi typically ranges between 3.5 lakhs to ₹6 lakhs. This includes the following:

Consultation and Diagnostics: Advanced tools like CBCT imaging and intraoral scans for precise planning.

Implants and Prosthetics: Premium Swiss implants and USA- or Spain-imported prosthetic materials for durability and aesthetics.

Surgical Procedures: Implant placement and immediate loading.

Follow-Up Care: Post-surgery evaluations to ensure success.

Know more about the technology used by Dr Vivek Gaur at www.doctorvivekgaur.com

Factors Influencing Full-Mouth Dental Implant Costs in Delhi

Material Quality: Using imported, high-grade implants and prosthetics contributes to the durability and aesthetics of the treatment.

Technology: Advanced tools like CAD/CAM technology and milling machines increase precision but also impact pricing.

Implantologist Expertise: Experienced specialists like Dr. Vivek Gaur ensure optimal results backed by decades of experience and expertise.

Case Complexity: Patients with severe bone loss or complex conditions may require additional procedures, affecting the overall expense.

Affordable Full-Mouth Dental Implant Options in Delhi NCR

At Dr. Vivek Gaur’s clinic, cutting-edge technology and expert care are synonymous with Affordable Dental Implants In Delhi.

No Extra Procedures: Corticobasal implants eliminate the need for bone grafting or sinus lifts, reducing costs.

Immediate Loading: Teeth are delivered in 72 hours, minimizing time and expenses.

Customized Solutions: Flexible payment plans, including EMI options, make treatment affordable.

Is It Worth Investing in Full-Mouth Dental Implants?

Absolutely! Full mouth dental implants offer long-term benefits like:

Natural-looking, functional teeth.

Jawbone preservation and improved oral health.

A one-time investment with results that last a lifetime.

FAQs

Q. What is the starting cost for full-mouth dental implants in Delhi?

Ans. The starting cost is approximately ₹3.5 lakhs, varying based on materials, no of implants, additional procedures, the expertise of the implantologist, and case complexity.

Know more about the technology used by Dr Vivek Gaur at www.doctorvivekgaur.com

0 notes

Text

Top Dental Implants in Hyderabad – Avighna’s Complete Guide

When it comes to enhancing your smile and regaining confidence, dental implants have emerged as a revolutionary solution. Hyderabad, a city known for its state-of-the-art healthcare facilities, is home to some of the finest dental clinics in India. Whether you’re an entrepreneur gearing up for a big presentation, a bride or groom looking to shine on your big day, or simply someone who values oral health, this guide is your ultimate resource for top dental implants in Hyderabad.

Why Choose Dental Implants?

Dental implants are a durable and aesthetically pleasing solution for missing teeth. Unlike dentures or bridges, implants mimic the natural structure of teeth, offering a permanent and hassle-free option. According to a study by the Indian Dental Association, 85% of dental patients in metropolitan cities like Hyderabad prefer implants due to their long-term benefits and natural appearance.

Hyderabad: A Hub for Advanced Dental Care

Hyderabad has established itself as a prime destination for dental tourism, thanks to its blend of cutting-edge technology and experienced professionals. Clinics here are equipped with advanced tools, and many follow international standards of care. From 3D imaging technology to minimally invasive procedures, Hyderabad’s dental clinics are on par with global practices.

Top Features of Leading Dental Clinics in Hyderabad

1. State-of-the-Art Infrastructure

The top dental clinics in Hyderabad boast modern facilities that ensure patient comfort and precision in treatments. Clinics like Avighna Dental Care use 3D imaging and CAD/CAM technology for designing custom implants.

2. Experienced Professionals

Hyderabad’s dental clinics are staffed with highly qualified and experienced professionals. For instance, Dr. Anil Reddy, a leading implantologist in Hyderabad, has over 15 years of experience and is renowned for his expertise in full-mouth rehabilitation.

3. Affordable Pricing

One of the key advantages of seeking dental implants in Hyderabad is the cost-effectiveness. Compared to cities like Delhi or Mumbai, Hyderabad offers world-class dental care at significantly lower prices. Clinics often provide comprehensive packages that include consultation, X-rays, and post-procedure follow-ups.

4. Customized Treatment Plans

Leading clinics prioritize personalized care, offering treatment plans tailored to individual needs. This ensures optimal results and enhances patient satisfaction.

Top Dental Clinics in Hyderabad

1. Avighna Dental Care

Renowned for its exceptional service, Avighna Dental Care is a go-to clinic for dental implants. With advanced facilities and a team of expert dentists, the clinic offers a seamless implant process.

Key Features: 3D imaging, painless procedures, and international-grade materials.

Offer: 20% discount on first-time consultations.

2. Apollo White Dental

Part of the reputed Apollo Hospitals group, this clinic is known for its comprehensive dental care services.

Key Features: Advanced diagnostic tools and highly skilled implantologists.

Offer: Free consultation for implant procedures during promotional periods.

3. Partha Dental

With multiple branches across Hyderabad, Partha Dental is a trusted name for dental implants.

Key Features: Affordable pricing, expert care, and flexible payment options.

Offer: EMI options available for implant treatments.

4. FMS Dental Hospital

FMS Dental is a pioneer in implant dentistry, known for its cutting-edge technology and globally trained specialists.

Key Features: Digital implant planning, same-day implants, and premium implant materials.

Offer: Discounts for senior citizens and students.

Expert Views on Dental Implants

Dr. Priya Mehta, a celebrated dentist in Hyderabad, says, “Dental implants are not just a cosmetic solution; they’re a functional necessity for many. Hyderabad’s clinics are equipped with the latest technology, ensuring successful outcomes.”

Current Trends in Dental Implants

1. Digital Implantology

The use of digital tools for precise implant placement is on the rise. Clinics in Hyderabad leverage 3D imaging and virtual simulations to enhance accuracy.

2. Minimally Invasive Procedures

Patients now prefer minimally invasive techniques that ensure quicker recovery and minimal discomfort. Laser-assisted surgeries are becoming popular in Hyderabad.

3. Same-Day Implants

Gone are the days of multiple visits. Many clinics now offer same-day implant procedures, saving time and effort for patients.

4. Zygomatic Implants

For patients with severe bone loss, zygomatic implants are a breakthrough. Hyderabad’s top clinics specialize in this advanced procedure.

FAQs About Dental Implants

Q1: Are dental implants safe?

Yes, dental implants are a proven and safe solution for missing teeth. When performed by qualified professionals, the success rate is over 95%.

Q2: How long do dental implants last?

With proper care, dental implants can last a lifetime. Regular dental check-ups and good oral hygiene are essential.

Q3: What is the cost of dental implants in Hyderabad?

The cost varies depending on the clinic, implant type, and additional procedures. On average, it ranges from ₹35,000 to ₹60,000 per implant.

Q4: Is the procedure painful?

Most patients report minimal discomfort as clinics use advanced techniques and local anesthesia.

Q5: How long does the procedure take?

The entire process, including healing, can take 3-6 months. However, some clinics offer immediate loading implants that reduce this time significantly.

Tips for Choosing the Best Dental Clinic

Check Credentials: Ensure the clinic has certified implantologists with a proven track record.

Read Reviews: Patient testimonials can provide valuable insights.

Visit the Clinic: A personal visit can help you assess the facilities and comfort level.

Compare Costs: Look for transparent pricing and value-added services.

Conclusion

Hyderabad is a hub for top-notch dental care, offering advanced solutions for dental implants. With clinics like Avighna Dental Care leading the way, patients can expect world-class treatments at affordable prices. Whether you’re looking to enhance your smile for a special occasion or seeking a long-term solution for missing teeth, this guide equips you with all the information you need to make an informed decision.

Take the first step towards a confident smile today. Book a consultation at one of Hyderabad’s top dental clinics and experience the transformative power of dental implants!

0 notes

Text

How to Improve Your Credit Sore: 8 Ways to Improve Credit Score

Also, read this article in हिंदी, मराठी, తెలుగు, தமிழ், ગુજરાતી, and ಕ��್ನಡ

Your Credit Information Report (CIR) plays a major part in the loan application process and hence a lower score can impact your chances for loan approval. So, if you’ve got had a bad credit history and you wish to improve your credit score then it’s important to know the choices that you simply have. Reaching a “credit repair” company and paying a huge sum of money might not be the simplest solution. Credit report isn’t related to any credit repair company.

Your credit score—a three-digit number lenders use to assist them to decide how likely it is they’ll be repaid on time if they grant you a credit card or loan—is very important considering your financial life. the higher your scores, the more likely you’re to qualify for loans and credit cards at the foremost favorable terms, which can save you money.

If you want to boost your credit score, there is a variety of easy stuff you can do. It takes a small amount of effort and, of course, some time.

Here’s a step-by-step guide to improve your credit score:

1. Pay Your All Bills on Time:

When lenders review your credit report and request a credit score for you, they’re very curious about how reliably you pay your bills. That’s because past payment performance is typically considered an honest predictor of future performance. You can positively influence this credit scoring factor by paying all of your bills on time as agreed every month. Paying late or settling an account for fewer than what you originally agreed to pay can negatively affect credit scores.

2. Eliminate Your Credit Card Balance:

The second thing you’ll do is to eliminate those credit card balances. Only spend as much amount as you’ll repay within the billing date. By balances, also mean any unpaid dues on loans and EMIs. Check with your lender and negotiate to end your loan account by paying off any unpaid dues. Such unpaid dues or balances on credit cards pull your score down. Paying off this amount will positively reflect on your credit score. Also, it’s better to own only one or two credit cards so it becomes easier for you to check track of repayments.

3. Audit Credit Realisation Ratio:

Using credit cards to buy everything you purchase may sound fancy, it should also get you a couple of reward points/cashback. But it’s recommended to check the credit utilization ratio within 30% or less of the available credit limit on your card. This rule can have a positive impact on the increase and managing your credit score. A low-balance credit card usage history reflects a healthy Credit score.

youtube

4. Connect with the Bank:

If you’re going through a tough phase and unable to pay your loans/credit card bills on time, don’t just stay quiet. it’s necessary that you simply visit the bank and communicate your hardships to let them know why you haven’t been ready to pay the installments on time. If you have had a good, well-maintained relationship with the bank, the bank will analyze your situation and provides you leeway in deferring the payments. The bank may do some adjustments such that missing payments won’t hamper your credit score.

5. Analyze for Inaccuracies:

Your financial behavior might not always be the explanation for a lower credit score. There could also be errors in your credit history information resulting in a lower score within the report. Verify your Credit report for errors; if you discover any, you can dispute it. The authorities will verify the details and make the required changes in your report. An error within the spelling of your name or a missing/additional transaction can flip the score the wrong way up.

6. Do not Abandon Any Credit Card:

With time, you’d have bought high-end credit cards and stopped using the first, basic card you had. Some people might think that it’s better to close the credit card account since it’s not getting used. However, this decision can affect your credit score. The credit rating agencies and lenders check out this act as if you’re incapable of managing different credit lines. It is recommended to carry on to all the credit cards you own even if it means to create a transaction only for the sake of ritual to stay your card operational. the amount and kinds of credit facilities you’re managing matters in improving your credit score

#homeloan#homefirstindia#home#financial planning#loan against property#welcome home#dream#construction#family#Youtube

1 note

·

View note

Text

Tips to Improve Your Credit Score Through Personal Loans with Kissht

Your credit score is more than just a number; it’s a critical measure of your financial health. A good credit score opens doors to financial opportunities, such as better loan terms, higher credit limits, and lower interest rates. While it may seem counterintuitive, responsibly using personal loans can be a powerful tool for improving your credit score. Platforms like Kissht make this process seamless, offering quick and convenient solutions like instant loans, and low-interest loans.

This blog explores practical and professional tips to help you improve your credit score through personal loans while leveraging platforms like Kissht for smarter financial management.

Understanding the Basics: What Is a Credit Score?

A credit score is a numerical representation of your creditworthiness, calculated based on your financial behavior and history. Key factors influencing your credit score include:

Payment history: Consistently paying bills on time significantly boosts your score.

Credit utilization ratio: The percentage of your credit limit that you use. A lower ratio indicates financial responsibility.

Length of credit history: A longer history shows more experience in managing credit.

Credit mix: A balance between credit cards, loans, and other credit types is ideal.

New credit inquiries: Multiple applications for credit within a short period can negatively impact your score.

Understanding these factors helps you use tools like personal loans to positively influence your credit profile.

Why Personal Loans Can Help Your Credit Score

Personal loans can be a strategic financial tool to improve your credit score when used responsibly. They offer structured repayment schedules, competitive interest rates, and the ability to consolidate debts, all of which can positively influence your credit profile.

Debt consolidation: Combining high-interest debts into one manageable loan.

Timely repayment: Building a history of on-time payments.

Diversified credit profile: Adding installment loans to your credit mix.

Platforms like Kissht provide access to instant loans with flexible repayment options, making it easier to manage your finances responsibly.

10 Ways to Improve Your Credit Score Using Personal Loans

1. Consolidate High-Interest Debt

Debt consolidation involves combining multiple debts into one loan with a lower interest rate. This not only simplifies your payments but also improves your credit utilization ratio. Platforms like Kissht allow you to apply personal loans for debt consolidation, offering competitive rates and flexible repayment options.

A low-interest loan reduces financial strain and makes timely repayment easier.

Paying off high-interest credit card balances with a personal loan online enhances your credit profile.

2. Always Pay Loan EMIs on Time

Payment history accounts for the largest portion of your credit score. Missing even one EMI can harm your score.

Use online personal loans from apps like Kissht for reminders and easy repayment tracking.

Set up auto-pay options on a cash loan app to avoid missed payments.

Consistently paying your EMIs on time demonstrates reliability, which is critical for improving your credit score.

3. Borrow Only What You Need

When considering a personal loan application, calculate the exact amount required. Over-borrowing can strain your finances and increase your chances of defaulting.

Use a quick loan app to assess your requirements before applying.

Opt for short-term loans or instant small loans to meet immediate financial needs without overextending yourself.

Apps like Kissht make it simple to apply for a loan tailored to your needs while keeping your credit in check.

4. Maintain a Low Credit Utilization Ratio

A high credit utilization ratio signals financial distress and negatively impacts your credit score.

Take advantage of online instant loans to pay off credit card balances and lower your ratio.

Avoid maxing out your credit limit by using a cash loan app for controlled borrowing.

A credit utilization ratio below 30% is ideal for maintaining a good credit score.

5. Avoid Multiple Loan Applications

Each loan application results in a hard inquiry, which can lower your credit score temporarily.

Instead of applying with multiple providers, choose a trusted instant loan app like Kissht that offers fast approvals and transparent terms.

Before applying, use a loan app to compare options and determine eligibility without impacting your score.

Limiting unnecessary inquiries preserves your creditworthiness.

6. Diversify Your Credit Portfolio

A healthy mix of credit accounts, such as credit cards, mortgages, and loans, positively impacts your credit score. Adding a personal loan online or using an instant personal loan app like Kissht can help diversify your credit profile.

A diversified credit mix shows your ability to manage multiple types of credit responsibly.

Use an online loan app to explore flexible options that fit your financial strategy.

7. Choose Low-Interest Loans

High-interest loans can be challenging to repay, leading to missed payments and a damaged credit score. Opt for low-interest loans through platforms like Kissht for manageable repayment terms.

Lower EMIs reduce financial pressure and increase your likelihood of timely repayment.

A well-managed personal loan application positively impacts your credit score over time.

8. Monitor Your Credit Score Regularly

Keeping an eye on your credit score helps you track your progress and identify areas for improvement.

Use tools available on online loan apps like Kissht to monitor your credit score.

Review your credit report periodically to ensure accuracy and dispute any errors.

Proactive monitoring is essential for staying on top of your financial health.

9. Use Instant Loans for Emergencies Only

While instant loans are convenient, they should be used judiciously. Borrow only in emergencies and ensure you can repay on time.

Platforms like Kissht offer instant money solutions for urgent needs with clear repayment schedules.

Avoid relying heavily on instant loan apps for non-essential expenses to maintain financial stability.

10. Leverage Short-Term Loans

Short-term loans are an excellent way to demonstrate financial responsibility and improve your credit score.

A quick loan app like Kissht offers easy access to instant small loans with short repayment periods.

Timely repayment of these loans showcases your ability to manage debt effectively.

Why Choose Kissht for Personal Loans?

Kissht simplifies the borrowing process, making it an ideal choice for improving your credit score. Here’s why:

Instant personal loan apps ensure quick approvals and easy access to funds.

Competitive interest rates help you secure low-interest loans tailored to your needs.

Flexible repayment options ensure you can manage your loan comfortably.

A seamless process to apply loan online through their online loan app, saving you time and effort.

Whether it’s an online instant loan, or a long-term financial plan, Kissht offers a trustworthy platform to meet your needs.

Final Thoughts

Improving your credit score with personal loans requires strategic planning and disciplined repayment. Whether consolidating debt, diversifying your credit profile, or managing urgent expenses, platforms like Kissht empower you with the right tools for success.

By using online loan applications responsibly, monitoring your credit score, and staying consistent with repayments, you can take control of your financial health. Explore Kissht today for tailored personal loan online solutions that make credit score improvement a seamless and achievable goal.

#personal loan app#Kissht Illegal#Kissht Fraud#Kissht#Kissht Banned#Kissht Fosun#instant money#loan app#advance loan#Kissht Suicide#instant loans#kissht reviews

0 notes

Text

Technology has impacted our lives in a positive manner and has relieved us from the stress of multiple things. Tasks that were quite difficult have become easy with the help of technology. In the domain of finance, technology has really helped people. The task of loans was very difficult and involved too much physical documentation. But with time, the task of taking and approval of loans, including consolidated debt loan, has become easy and digital.

Borrowers can even schedule their EMIs and the system shall leave a reminder so that a borrower will never miss EMIs. The documentation required for the loan approval can also be done online. Even there are some banks and NBFCs that are providing you with the loan amount of your eligibility. The rise in technology has definitely brought ease among people who are utilizing financial services. After taking the loan comes the stage of repaying it, which might become difficult for the people if they have not planned it. A planned loan shall bring you ease and become a road to fulfill your dreams. The article below will help you understand the strategies for loan repayment and consolidating debt options.

Advantages of Repaying Loans on Time?

Repayment of the loan is the next step after your loan gets approved and disbursed. Repaying the loan has become easy with the help of time. Here are a few advantages of repaying the loan anytime.

Repaying a loan on time will maintain your CIBIL Score. It shall also help you to build your credit score.

Repayment of the loan on time will also make a person eligible for a loan of a higher loan amount.

Sometimes EMI of the loan is scheduled on the date before your salary comes. It is preferable to set the date after you receive your salary. Repaying EMI even after one day shall make you a defaulter. Many banks provide you with the facility to schedule the EMI on a particular date.

Loan repayment will also make you eligible for the Top-Up loan that is approved based on the timely payment of an existing loan.

Repaying loans on time will help you to make good relations with the bank. You can also opt for the balance transfer if you have good relations with your bank.

How to Repay Loan Wisely

Understand Your loan

Get a clear understanding of your loan, including the interest rate, EMI of the loan, and tenure period of the loan. Talk to the bankers and get detailed information on all the terms and conditions for the loan. Before signing the loan agreement you should have all the information with you.

Monthly Budget

Prepare a monthly budget so that you will never run out of money and loan EMIs will no more scare you. Budgeting is a good option if you are considering winding up the loan early. In addition, you shall have a clear idea of where your money is going per month.

Focus on your debt with the highest interest rate

If you have multiple loans then choose to wind up the loan that has the highest interest rate. In this way, you shall be free from the debt early, by paying the principal amount and interest money before time.

Prioritize your loan with the lowest outstanding amount

If you are running low on money then instead of repaying the loan with the highest interest rate first, start by paying the loan that has the lowest outstanding amount. And then moving on with the loan that has the second least loan amount.

Debt consolidation

A method where you take a single loan to pay off other loans. This might be a good option if you are overburdened with Loans.

Pay extra money toward debt

Pay an extra EMI in the year will help you to wrap up the loan a bit early than expected. Pay 13 EMIs instead of 12 and it will wind up the loan early.

Debt Consolidation

Take out a new loan or credit card to pay off other existing loans or credit cards. This is known as loan debt consolidation. You might be able to get better payout terms by merging several loans into one, larger one, such as a lower interest rate, cheaper monthly payments, or both.

Conclusion

The article above will explain to you the repayment of loans. The advantages of repayment of loans and debt-consolidation. It shall guide you in the process of repayment of the loans. It is important to make a strategy for the repayment of the loan. Become financially aware and travel on the road to success.

0 notes

Text

Personal Loan vs. Credit Card: Which Is Better for You? 💳💰

We’ve all been there — you need funds fast, and the big question pops up: Do I take a personal loan or swipe my credit card? 🤔

Here’s a quick breakdown to help you decide:

✅ Personal Loan:

Lower interest rates (compared to credit cards).

Fixed EMIs, so you can plan repayments better.

Ideal for big expenses like home renovations, weddings, or debt consolidation.

✅ Credit Card:

Great for small, short-term expenses (like shopping or emergencies).

Interest-free period (up to 45-50 days) – but beware of high interest if you miss payments!

So, Which Wins?

If you’re looking for lower rates, structured repayment, and peace of mind, a Personal Loan may be your best bet. 💪

At F2Fintech, we make personal loans simple, fast, and hassle-free — tailored to your needs. 💻💼

👉 Need funds? Explore your options here:

Because your financial choices should work for you!

1 note

·

View note

Text

How Much Do Dental Implant Cost? Locations, and Everything You Need to Know

Dental implants have revolutionized tooth replacement, offering a permanent solution for missing teeth that looks, feels, and functions like natural teeth. If you're considering dental implants, you likely have questions about cost, local availability, and overall value. This comprehensive guide will walk you through everything you need to know about dental implants.

How Much Do Dental Implants Cost?

The cost of dental implants can vary significantly depending on several factors:

1. Number of Implants: A single tooth implant will cost less than multiple or full-mouth implants.

2. Location of the Dental Practice: Prices differ between urban and rural areas.

3. Dentist's Expertise: More experienced specialists may charge higher rates.

4. Additional Procedure: Bone grafts, sinus lifts, or other preparatory treatments can increase overall costs.

Finding Dental Implants Near Me

When searching for "dental implants near me," consider the following steps:

1. Research Local Dentists: Use online directories, Google Maps, and local dental associations.

2. Check Credentials: Look for dentists specializing in implantology.

3. Read Reviews: Patient testimonials can provide insights into quality of care.

4. Consultation: Most dental clinics offer initial consultations to assess your specific needs.

Cost of Dental Implants in Latur

For residents of Latur, dental implant costs may differ from national averages. Local factors to consider include:

Local dental clinic competition

Cost of living in the region

Availability of specialized dental implant services

In Latur, you might find:

Single tooth implants ranging from ₹15,000 to ₹40,000

Multiple implant packages with potential discounts

Varying prices based on the clinic's technology and expertise

Important Considerations Before Getting Dental Implants

Factors Affecting Total Cost

Implant material (titanium is most common)

Crown type (porcelain, ceramic, or zirconia)

Need for additional treatments

Insurance and Financing

Check if your dental insurance covers implants

Many clinics offer EMI or payment plans

Some dental colleges provide more affordable options

Procedure Overview

1. Initial consultation and X-rays

2. Possible bone grafting

3. Implant placement surgery

4. Healing period

5. Crown attachment

Tips for Reducing Dental Implant Costs

Compare quotes from multiple clinics

Check for seasonal offers or packages

Consider dental tourism within India

Discuss comprehensive treatment plans

Final Thoughts

While dental implants represent a significant investment, they offer long-term benefits:

Permanent tooth replacement

Improved oral health

Enhanced aesthetic appearance

Better functionality compared to dentures

Always consult with a qualified dental professional to get a personalized assessment and accurate cost estimate for your specific dental implant needs.

#dental care#dental clinic#dentistry#top root canal doctors in latur#dentist#dental treatment#emergency dentist#orthodontist in latur

0 notes

Text

Managing finances effectively is essential to achieving financial stability, and one way to do so is by opting for a personal loan balance transfer. This process allows borrowers to transfer their existing personal loan to another lender offering better terms, such as a lower interest rate or more flexible repayment options. If you’re considering a balance transfer personal loan, it is crucial to first check your eligibility to ensure a seamless experience.

What is a Personal Loan Balance Transfer?

A personal loan balance transfer involves transferring the outstanding amount of your existing personal loan from one lender to another. Borrowers often choose this option to take advantage of reduced interest rates, lower EMIs, or better service from a new lender. This facility can lead to substantial savings over the loan tenure.

Benefits of a Personal Loan Balance Transfer

Lower Interest Rates: Reduce your overall interest payout by switching to a lender offering competitive rates.

Reduced EMI Burden: Lower EMIs can improve your monthly cash flow.

Additional Loan Top-Up: Some lenders offer top-up loans along with balance transfer facilities.

Better Terms and Conditions: Enjoy improved repayment flexibility or extended tenures.

How to Check Eligibility for a Balance Transfer Personal Loan

To ensure you qualify for a personal loan balance transfer, lenders typically assess the following criteria:

Credit Score: A credit score of 750 or above is often preferred by lenders. A good score reflects your creditworthiness and repayment history.

Loan Repayment History: Ensure that you have consistently made timely payments on your existing loan. Missed EMIs or delays may impact your eligibility.

Employment Stability: Most lenders require borrowers to have stable employment. Salaried individuals should ideally have 1-2 years of work experience, while self-employed individuals must show a steady income flow.

Remaining Loan Tenure: Lenders may have a minimum tenure requirement for transferring the balance. For example, some may only allow transfers if the remaining tenure exceeds 6-12 months.

Loan Amount: The outstanding loan amount should fall within the minimum and maximum limits set by the new lender.

Steps to Check Eligibility Online

Visit the Lender’s Website: Navigate to the balance transfer section on the lender’s site.

Provide Basic Details: Enter your existing loan details, such as the outstanding amount, tenure, and interest rate.

Use an Eligibility Calculator: Many lenders offer online tools to instantly check your eligibility for a personal loan balance transfer.

Submit Documents for Verification: Upload essential documents like ID proof, income proof, and loan account statements for further evaluation.

Key Documents Required for Balance Transfer

Identity proof (Aadhaar, PAN, etc.)

Address proof

Salary slips or income tax returns (ITR)

Bank statements for the last 6-12 months

Loan account statement from the existing lender

Tips for a Successful Balance Transfer

Compare Offers: Research multiple lenders to find the best deal.

Calculate Savings: Use an EMI calculator to determine potential savings.

Negotiate: Don’t hesitate to negotiate for lower processing fees or better terms.

Conclusion

A personal loan balance transfer can be a smart financial move if done right. It helps you reduce the cost of borrowing, improves cash flow, and offers better loan terms. Before proceeding, carefully check your eligibility and evaluate the savings potential. With online tools and resources, the process has become simpler and faster, enabling you to manage your personal loan effectively.

0 notes

Text

Best Dentist In Ranchi

Experience World-Class Dental Care at GenNext Dental Lounge - Leading Dentist in Ranchi The right dental clinic is critical when it comes to ensuring that one has a confident smile and maintaining the best oral health. GenNext Dental Lounge is undoubtedly the "best dentist in Ranchi," providing top-notch dental care with commitment to excellence. With its patient-first approach, cutting-edge technology, and expert dentists, GenNext Dental Lounge has established itself as a trustworthy name in the field of dentistry. Why Choose GenNext Dental Lounge? GenNext Dental Lounge specializes in personalized and holistic dentistry solutions for patients at all ages. Here are some reasons why it becomes the best choice: 1. Experienced Team of Dentists: The clinic is led by dentists with a high qualification and experience in particular dental specialties, such as cosmetic dentistry, orthodontics, periodontics, or endodontics. 2. State-of-the-Art Facility: The clinic is equipped with modern dental technology and tools, which ensure accurate diagnostics and effective treatments. 3. Wide Range of Services: From preventive care and routine checkups to advanced procedures like dental implants and orthodontic treatments, GenNext caters to all your dental needs under one roof. 4. Patient-Centered Care: At GenNext, patients are treated with compassion and respect. The staff takes the time to understand your concerns and create a tailored treatment plan to meet your specific requirements. Services Offered at GenNext Dental Lounge GenNext Dental Lounge provides a comprehensive range of dental services to ensure that every aspect of your oral health is covered: 1. Preventive Dentistry - Routine checkup and cleaning at the dentist - Dental sealants to prevent cavities - Fluoride treatment for healthier, stronger teeth 2. Restorative Dentistry Fillings to repair cavities Root canal treatment to salvage an infected tooth Crowns and bridges for fix or replacement of missing or damaged teeth 3. Cosmetic Dentistry Whitening of the teeth for that dazzling bright smile - Veneers to reshape the look of the smile Smile makeovers as designed by preference

4. Orthodontics - Correcting orthodontic malaligned teeth by using braces or Invisalign. After orthodontic treatment retainers for retention.

5. Dental Implants Permanent solutions to missing teeth through dental implants. Stability could be better with implant-support dentures.

6. Pediatric Dentistry Pediatric specialist care to cater for children needs. - Preventive and restorative treatments for kids 7. Emergency Dental Care - Quick and effective solutions for dental emergencies such as toothaches, broken teeth, or injuries Advanced Technology for Superior Care GenNext Dental Lounge invests in the latest dental technology to deliver accurate diagnoses and comfortable treatments. From digital X-rays and 3D imaging to pain-free anesthesia techniques, the clinic ensures a seamless experience for patients. Comfort and Convenience for Patients For many, the dentist is a scary place; however, GenNext Dental Lounge looks to make the experience very warm and inviting. In terms of design, the clinic is created to soothe anxiety, and the kind staff is always there to answer any concerns. Flexible appointment scheduling and adherence to strict hygiene protocols further enhance the patient experience. Affordable and transparent pricing GenNext Dental Lounge believes in bringing quality dental care to everyone's reach. There is transparent pricing, without any hidden costs. Thus, the patient exactly knows what he or she is paying for. They provide a variety of payment options including flexible EMI plans that make treatment easy and more affordable. Building Smiles, One Patient at a Time The mission of GenNext Dental Lounge is to deliver excellent dental care that assists patients in achieving healthy, confident smiles. With hundreds of satisfied patients and glowing reviews, the clinic continues to set the benchmark for dental services in Ranchi. Visit GenNext Dental Lounge Today GenNext Dental Lounge is the name you can trust if you're looking for the "best dentist in Ranchi". Whether it's a routine checkup, a cosmetic procedure, or a dental emergency, the clinic is well-equipped to handle all your dental concerns with professionalism and care. Book your appointment today and experience the GenNext difference. Your journey to a healthier, more beautiful smile starts here!

1 note

·

View note

Text

Online gold coin purchase in India.

In India, gold holds a special place culturally and financially. Known as a symbol of wealth, prosperity, and security, gold is cherished as both an investment and a sign of good fortune. Traditionally, buying gold meant visiting a jewelry store in person, but today, online gold purchases are on the rise. This article will guide you through the process, benefits, and considerations for Online gold coin purchase in India.

The Rising Trend of Online Gold Coin Purchases

As e-commerce continues to reshape shopping habits, gold is no exception. Buying gold online, especially gold coins, has become a popular option. Leading jewelry brands and financial platforms offer safe and convenient ways to buy gold coins digitally.

India's e-commerce space has allowed consumers to browse, compare, and make well-informed purchasing decisions from the comfort of their homes. However, given the financial and emotional value attached to gold, it's essential to choose a reputable provider. With the growing demand, the best online jewellery shop in India offers trusted options for online gold purchases, ensuring quality and authenticity.

Why Buy Gold Coins Online?

Convenience

Buying gold coins online provides the convenience of shopping at any time and from anywhere. There’s no need to visit multiple stores to compare prices or worry about missing out on a deal due to store hours.

Variety

Online shopping offers an extensive selection of gold coins in various weights, designs, and levels of purity, which may not always be available in physical stores.

Pricing Transparency

Online platforms provide real-time gold rates, ensuring pricing transparency. This transparency means buyers can track fluctuations and make purchases when prices are favorable. Additionally, the best online jewellery shop in India frequently offers discounts and promotions that are not always available offline.

Secured Delivery

Reputable online stores ensure that gold coins are securely packaged and delivered. Most platforms use insured shipping and offer options for tracking, guaranteeing safe and timely delivery.

Choosing the Right Gold Coin Online

1. Purity

Gold coins in India are generally available in two purity levels: 22-karat and 24-karat. 24-karat gold coins are the purest form, containing 99.9% gold, whereas 22-karat coins have around 91.6% gold, mixed with a small percentage of other metals for durability. For investment purposes, 24-karat coins are preferred, but for gifting, both options are popular.

2. Weight

Gold coins come in various weights, commonly ranging from 1 gram to 100 grams or more. For smaller investments or gifts, 1, 2, 5, or 10-gram coins are widely purchased. Higher-weight coins, like 50 or 100 grams, are preferred by those seeking long-term investments.

3. Brand Certification

Leading gold providers, especially the best online jewellery shop in India, issue branded gold coins with BIS (Bureau of Indian Standards) certification, assuring authenticity and purity.

4. Design

Some buyers prefer plain coins, while others choose coins embossed with religious symbols or deities, especially during festive occasions. Online stores offer a wide variety of designs, allowing buyers to select based on personal preference and occasion.

How to Safely Make an Online Gold Coin Purchase in India

1. Choose a Reputable Online Store

The first step in making a secure online gold coin purchase in India is to select a reputable online jewelry platform. Major online platforms offer BIS-certified coins and guarantee purity. Look for customer reviews, certification, and transparency about returns and refunds.

2. Check Payment Options

Reliable platforms offer multiple payment options, including credit/debit cards, net banking, and UPI. Secure payment gateways ensure your information remains protected. For added convenience, some websites offer EMI options on larger purchases.

3. Verify Certification and Documentation

A hallmark or purity certificate guarantees the gold coin's quality and is crucial for resale value. Online platforms generally provide certificates from BIS or other reputed organizations.

4. Insured and Secure Delivery

Once the purchase is complete, a reputable store ensures the gold coin is safely delivered with proper insurance coverage. Always check the delivery timeline and tracking options provided by the platform.

Top Online Platforms for Gold Coin Purchases

Many reputable platforms offer online gold coin purchase in India. Here are a few trusted ones:

Tanishq Tanishq offers a wide range of 24K and 22K gold coins with the purity and craftsmanship assurance the brand is known for. Each coin is BIS-certified and available in multiple weights, making Tanishq a preferred choice.

Malabar Gold and Diamonds Known as one of the best online jewellery shop in India, Malabar Gold and Diamonds offers high-quality, BIS-certified gold coins with assured purity. They provide a wide range of designs, including religious motifs, and secure delivery options.

Senco Gold & Diamonds Senco offers various denominations and a hassle-free online buying experience with BIS-certified coins. Their customer-friendly website, purity guarantee, and attractive designs make them a popular choice for gold coin purchases.

MMTC-PAMP A trusted bullion provider, MMTC-PAMP ensures exceptional purity standards. They provide coins in multiple denominations and issue a certificate of authenticity with each coin.

Kalyan Jewellers Kalyan Jewellers offers a variety of gold coins with purity assurance and is popular for its competitive pricing and customer-centric services.

Benefits of Investing in Gold Coins

Liquidity

Gold coins are highly liquid and can be easily sold, making them an ideal asset for those seeking quick cash availability.

Wealth Preservation

Gold is known to preserve its value over time and is often considered a hedge against inflation.

Tangible Asset

Unlike digital gold, gold coins are a tangible asset you can hold, giving a sense of security to investors who prefer physical assets.

Gifting

Gold coins are a traditional gift for weddings, birthdays, and festivals. They are seen as a symbol of good fortune, making them a cherished and valuable present.

Essential Tips for Gold Coin Buyers

Buy from Certified Sellers

Only buy from certified sellers and reputable online stores. Always prioritize purity and certification when making an online gold coin purchase in India.

Consider the Making Charges

Making charges on gold coins are usually lower than jewelry, but they can still vary. Some stores waive these charges during festive sales, so keep an eye out for discounts.

Track Gold Prices

Gold prices fluctuate daily. Monitoring prices can help you make a purchase when prices are favorable.

Store Safely

After buying gold coins, store them securely. Many banks offer safety deposit lockers, and home safes are also an option.

Stay Updated on Taxes

Understand the tax implications of buying and selling gold in India. Gold purchases above a certain threshold require PAN details, and capital gains tax may apply to profits on gold investments.

FAQs on Online Gold Coin Purchase in India

Is it safe to buy gold coins online in India?

Yes, buying gold coins online is safe if you choose a reputable provider. Ensure the platform provides BIS certification, secure payment methods, and insured delivery.

What is the difference between 22K and 24K gold coins?

22K gold coins contain 91.6% pure gold, while 24K coins are 99.9% pure. For investment purposes, 24K coins are preferred due to their higher purity.

Can I return or exchange gold coins bought online?

Return policies vary among online platforms. Reputable sellers offer return or exchange options, usually within a specified timeframe, but it’s best to check each provider’s policy.

Which is the best online jewellery shop in India to buy gold coins?

The best shop depends on personal preferences, but Tanishq, Malabar Gold and Diamonds, and Senco Gold & Diamonds are highly rated for their selection, certification, and secure delivery options.

Are there any extra charges when buying gold coins online?

Besides the gold price, there may be making charges, taxes (like GST), and delivery charges. However, these charges are often transparently listed by the best online jewellery shop in India platforms.

Final Thoughts on Online Gold Coin Purchases

The convenience, variety, and transparency of buying gold coins online make it an attractive option for buyers in India. However, as with any investment, due diligence is essential. By purchasing Online gold coin purchase in India from reputable online platforms and focusing on certification, purity, and secure delivery, buyers can ensure a safe and rewarding gold coin purchase experience.

0 notes